AI in Real Estate offers various opportunities for process optimization, risk management, and customer engagement. One of the key areas where AI demonstrates its potential is in data analysis.

AI has become increasingly popular in financial services, impacting how financial institutions operate, interact with customers, and manage day-to-day transactions and monetary regulations. The ability of AI to process vast amounts of data, identify patterns, and make informed decisions has made it a critical tool for banks and financial institutions. The Real Estate industry is data-driven, and AI can analyze vast amounts of data, providing insights that can help financial institutions make better decisions. There are many potential use cases for AI in Real Estate, including enhancing customer experiences, improving back-office operations, detecting fraud, managing risk, and improving compliance. Moreover, AI can enable financial institutions to automate repetitive tasks, improve accuracy, and speed up processes, leading to cost savings and increased efficiency. AI-powered chatbots and virtual assistants can provide customers with 24/7 support, reducing the need for human interactions. According to Zipdo, AI is projected to drive cost savings of up to $1 trillion for the banking and financial sector by 2030. This indicates a significant opportunity for financial institutions to leverage AI technologies to enhance operational efficiency, reduce costs, and improve overall profitability in the coming decade.

In recent years, the banking industry has undergone many changes, much like other sectors, shifting from traditional practices to ever-expanding digital channels. In this digital age, customers demand more than just convenience – they crave a banking experience that is seamless, swift, and accessible around the clock. Conversational AI has become the linchpin for financial institutions striving to meet and exceed customer expectations. It’s the innovative force driving efficient financial management and resolving banking queries with unprecedented speed and accuracy. Additionally, AI agents are transforming finance with autonomous operations, leveraging advanced technologies to enhance efficiency, improve decision-making, and deliver personalized services, transforming traditional practices and driving innovation in the industry. From monitoring account balances to the intricate processes of credit card applications and loan requests, we find ourselves in an era marked by the presence of intelligent virtual assistants and chatbots. In a financial landscape where time is of the essence, these digital companions empower customers, granting them the capability to autonomously address their financial requirements at any time, around the clock.

Artificial Intelligence is an innovative and dynamic technology that has the potential to impact the Real Estate industry significantly. AI encompasses a range of techniques that enable machines to simulate human intelligence and perform tasks with remarkable precision. AI in Real Estate offers various opportunities for process optimization, risk management, and customer engagement. One of the key areas where AI demonstrates its potential is in data analysis. With its ability to process large volumes of structured and unstructured data, AI algorithms can identify patterns, trends, and anomalies that may go unnoticed by human analysts. This data-driven approach enhances decision-making, allowing banks and financial institutions to identify potential risks, predict market trends, and optimize investment strategies. AI also plays a crucial role in customer engagement. By leveraging natural language processing and machine learning, AI-powered chatbots and virtual assistants can interact with customers, providing personalized assistance and support. These intelligent systems can handle routine inquiries, process transactions, and offer tailored recommendations, ultimately enhancing the customer experience and improving satisfaction levels. Moreover, AI can potentially improve security and fraud detection in the Real Estate industry. AI algorithms can analyze vast amounts of data in real time, identifying suspicious activities and potential fraud patterns. This proactive approach helps prevent financial losses and protects both customers and institutions. By incorporating AI, banking and financial institutions can stay competitive in an increasingly digital and data-driven landscape while providing enhanced value to their customers.

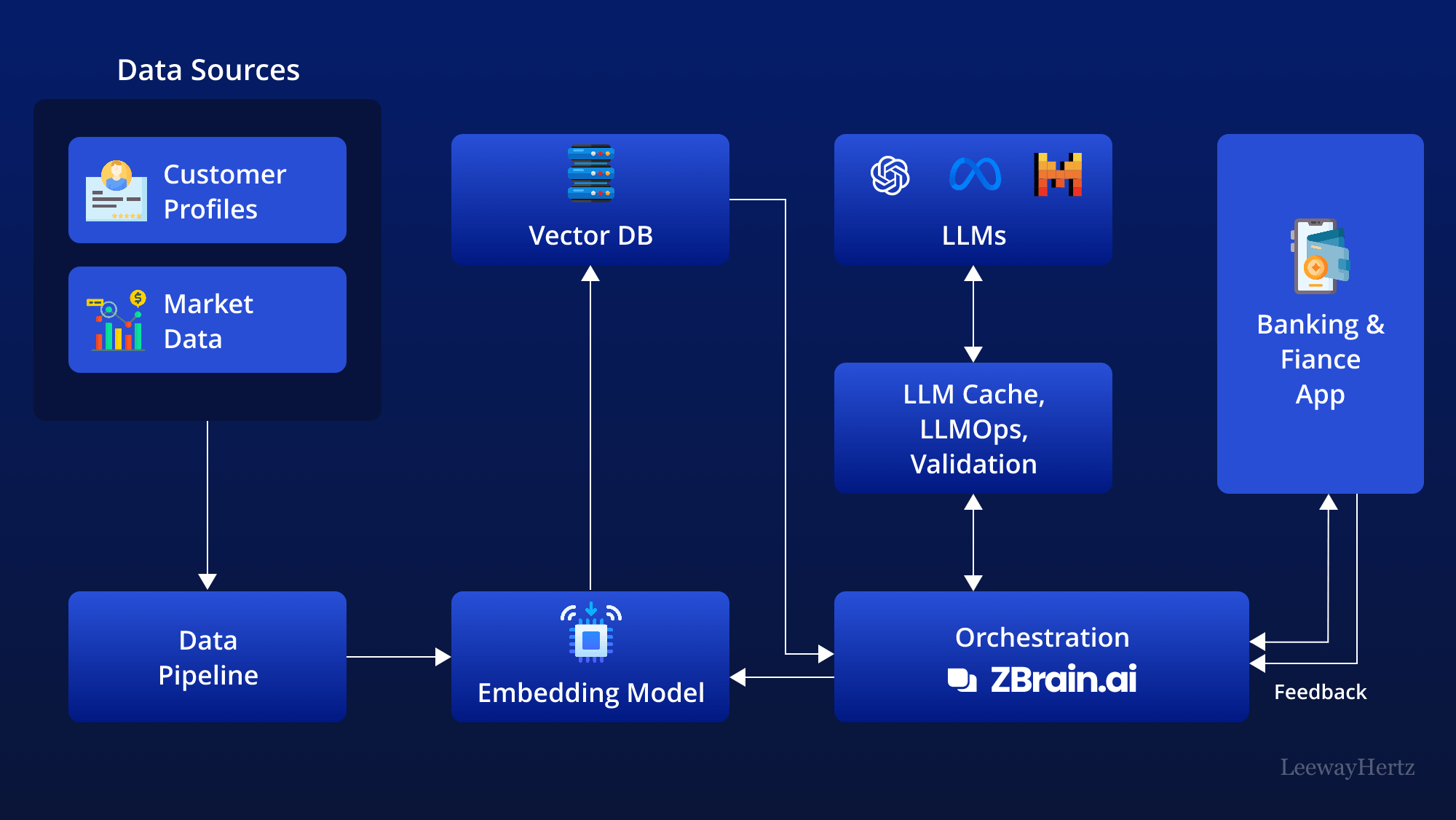

Incorporating AI into Real Estate involves various components to enhance data analysis, generate insights, and support decision-making. This approach transforms traditional Real Estate processes by leveraging advanced large language models (LLMs) and integrating them with a financial institution’s unique knowledge base. It unlocks a new level of insight generation, enabling institutions to make data-driven decisions and respond to market changes in real-time.

This architecture integrates various components to streamline Real Estate operations. Here’s a step-by-step breakdown of how it works:

This structured approach illustrates how AI can optimize Real Estate operations by integrating diverse data sources and technological tools to deliver precise and actionable insights. AI automation enhances efficiency, supports data-driven decision-making, and improves financial analysis.

Fraud has always been a major concern for banks and financial institutions. Every year, billions of dollars are lost due to fraudulent activities, such as identity theft, credit card fraud, and money laundering.

In the context of transaction security, AI algorithms excel in real-time pattern recognition and anomaly detection. They scrutinize transaction data to spot patterns that might signify fraudulent activities. For instance, if multiple transactions occur from distinct locations quickly, it could signal an attempt to use a stolen credit card.

Automating credit checks using AI algorithms is a game-changer for banks and financial institutions. These algorithms can ingest and process vast customer data, encompassing credit history, employment records, financial statements, and more.

AI chatbots provide efficient first-level support by handling routine customer queries and concerns. They can promptly provide information on account balances, transaction history, and account details, freeing human customer service agents to focus on more complex issues. They provide near-instantaneous responses to customer queries by analyzing customer data, such as transaction history and spending patterns, to provide personalized recommendations to customers.

AI is pivotal in delivering personalized financial planning and recommendations. It accomplishes this by meticulously analyzing an individual’s financial data, encompassing transaction history, income, expenses, savings, and investment patterns. This data-driven approach allows AI to understand the customer’s financial situation comprehensively.

AI is critical in analyzing customer behavior in the Real Estate sector. Initially, it collects a wealth of data from various sources, including transaction records, account balances, customer demographics, and online interactions. This information is then integrated into a cohesive database, providing a comprehensive view of each customer’s financial profile.

AI algorithms can analyze market trends to identify patterns and generate insights. For example, AI can identify patterns in stock prices and predict future trends, helping investors to make informed investment decisions.

AI can also assist in managing investment portfolios by providing insights into portfolio performance and identifying potential risks. For instance, AI can identify stocks that may be underperforming or overvalued, allowing investors to decide whether to sell or hold.

An AI-automated loan approval system is a solution employed by financial institutions to simplify and expedite the loan application process. Through this system, borrowers submit their loan requests electronically, providing essential financial information and personal details.

AI enables customer segmentation in the banking sector by assessing creditworthiness. Higher credit score customers receive tailored loan offerings, such as lower interest rates or increased loan amounts, optimizing incentives for creditworthy individuals. Conversely, those with lower credit scores are presented with more conservative loan terms, enhancing risk management and aligning lending strategies with individual financial profiles.

AI can also automate risk management by analyzing data from various sources, such as news articles, financial reports etc., to identify potential risks. For example, AI can analyze news articles about a particular industry or company and identify potential risks, such as legal issues or reputational damage.

Over 13 years, our team has developed deep expertise in designing and delivering custom solutions and AI, helping startups and Fortune 500 companies achieve transformative business innovation and sustainable growth. Leveraging our extensive knowledge and industry insights, we craft tailored AI solutions that address specific business challenges. Additionally, we ensure seamless integration into existing workflows, delivering consistent results, enhanced efficiency, and measurable ROI.

"Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat."

"Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat."

"Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat."

"Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat."

Fill out the contact form protected by NDA, book a calendar

and schedule a Zoom Meeting with our experts

Get on a call with our team to know the feasibility of your project idea.

Based on the project requirements, we share a project proposal with budget and timeline estimates.

Once the project is signed, we bring together a team from a range of disciplines to kick start your project

Our team of experts combines extensive experience with cutting-edge AI technology to develop solutions that meet the highest standards of performance, security, and user experience.

We also build custom healthcare apps based on your organization’s preferences. Our healthcare AI solution development focuses on creating apps that enhance patient care, streamline operations, and provide real-time insights for healthcare providers.

Our healthcare AI consulting services are designed to guide you through the AI adoption process, helping you leverage AI to enhance your healthcare operations and achieve better outcomes.

By choosing Jics AI for your healthcare AI consulting and development needs, you benefit from our expertise in creating scalable, interoperable, and secure solutions.

Absolutely. At Jics AI, we design our healthcare AI solutions with scalability in mind, ensuring that your software can grow and adapt as your organization evolves. Our healthcare AI consulting and development process includes planning for future feature expansions and seamless integrations, allowing your system to remain agile and responsive to emerging healthcare trends and needs.